Australian exporters can expect to benefit from the rising global demand for sheepmeat. Australian farmers will also enjoy better producer prices.

The OECD-FAO expects global sheepmeat consumption to increase by 15% to 18.1 million tonnes (MT) over the next decade. This is up from 15.9 MT in 2021.

Demand will be driven by increased meat consumption in developing countries and more consumers becoming familiar with sheep meat in wealthy countries. Producer prices for Australian sheep meat are also expected to increase at a faster rate than other meat. This is due to higher relative consumption of more expensive lamb products.

FIGURE 1 : OECD-FAO FORECAST FOR SHEEP MEAT CONSUMPTION AND INTERNATIONAL TRADE STATISTICS TO 2031

IMPLICATIONS FOR AUSTRALIAN EXPORTERS

Australian exporters will benefit from growing demand for sheep meat. Australia is the world’s largest sheep meat exporter. The country has strong trading relationships with high-consumption growth markets.

Recent free trade agreements (FTAs) with the UK and India have improved Australia’s export opportunities. Australia is also seeking improved access to the European Union (EU) through the Australia-EU FTA. This FTA is under negotiation.

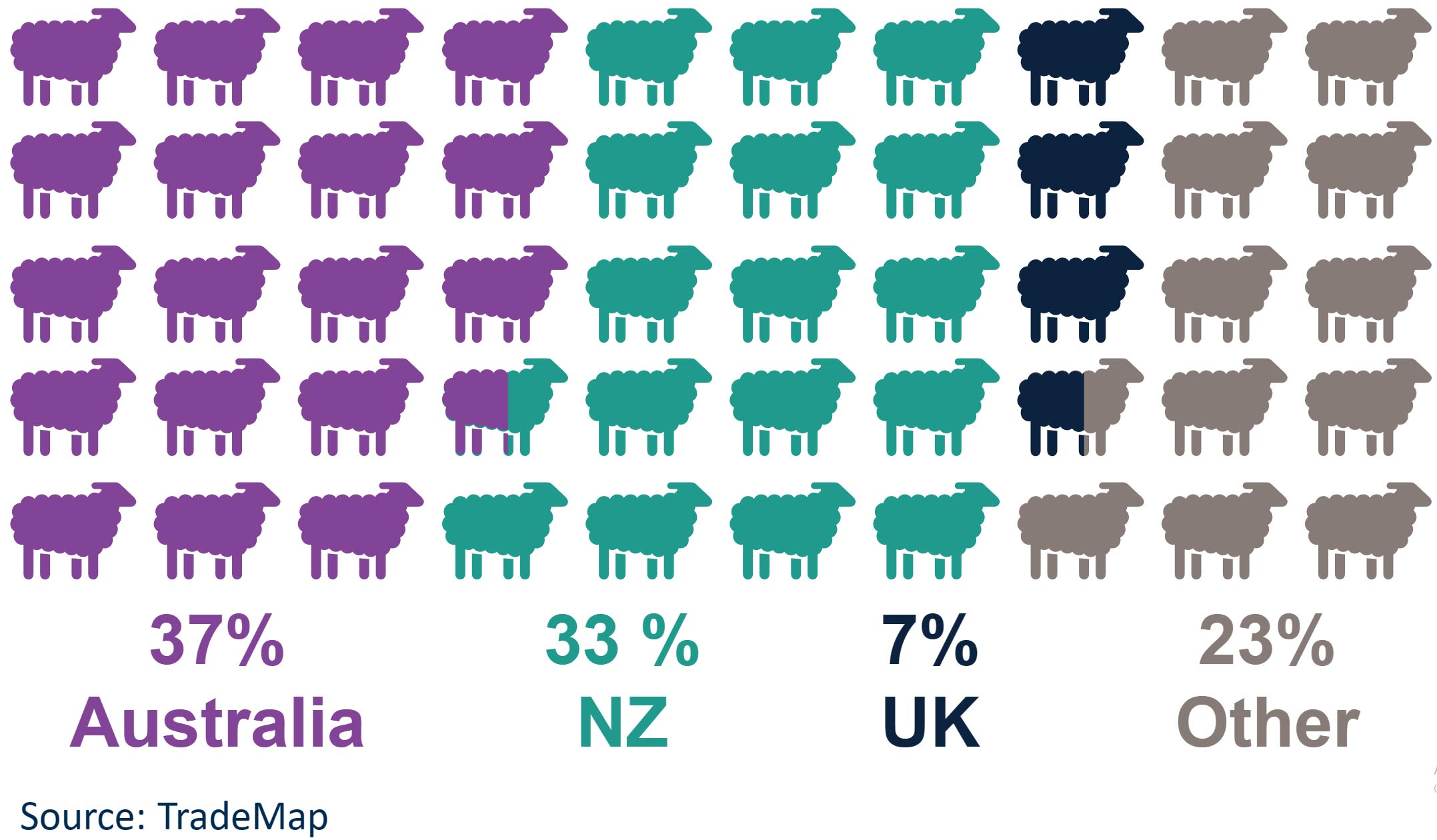

FIGURE 2 : TOP THREE GLOBAL SHEEP MEAT EXPORTERS (2021)

OUTLOOK FOR GLOBAL SHEEP MEAT TRADE

Between 2019 and 2021, sheep meat accounted for 1.5% of the 120.8 MT of global meat consumption. China and the US are the largest consumers of sheep meat. Australia exported an average of US$3.2 billion of sheep meat each year, accounting for 37% of global exports. New Zealand (US$2.9 billion, 33% of world total) and the UK (US$0.6 billion, 7% of world total) are the other major sheep meat exporters.

The OECD-FAO expects sheep meat consumption to increase by 15% over the next decade to 18.1 MT, up from 15.9 MT in 2021. Countries in Africa are driving consumption growth, where domestic production will meet most of the demand. Consumption is also increasing in Asia and North America, where imports will be more important.

Australia is expected to meet a large share of the growing global demand for sheep meat. The OECD-FAO predicts Australian sheep meat production will increase 19% by 2031 to 806,000 t. This is up from 692,400 t in 2021.

SHEEP MEAT TO BENEFIT FROM GLOBAL INCREASE IN MEAT CONSUMPTION

As countries get wealthier, meat consumption tends to increase. Wealthy consumers in Asia are the main drivers behind increased global meat consumption. The OECD-FAO expects sheep meat consumption in China (+13%) and Malaysia (+11%) to rise over the next decade. China and Malaysia are important markets for Australian mutton exports (sheep older than one year). Mutton is usually less expensive than lamb, which makes it attractive to less wealthy consumers.

SHEEP MEAT CONSUMPTION TO RISE IN DEVELOPED COUNTRIES

Once GDP per person reaches approximately US$40,000, meat consumption tends to plateau. However, sheep meat remains relatively unfamiliar to many global consumers. As familiarity increases, sheep meat has the potential to take a larger share of meat consumption in wealthy countries, even if overall meat consumption remains stable.

Wealthy countries, such as the US, are more likely to prefer lamb. The value of Australian lamb exports to the US increased by 56% to A$1.16 billion in 2021–22, relative to the 2018–19 to 2020–21 average.

PRICES FOR SHEEP MEAT TO RISE QUICKER THAN OTHER MEATS

The OECD-FAO has forecast a 48% increase in producer price for Australian sheep meat over the next decade. The producer price represents the amount farmers receive when sheep leave the farm, excluding transport and processing costs. In comparison, the producer price for beef is expected to be relatively flat.

Increased producer prices are partly explained by an expected increase in the proportion of lamb, rather than mutton, in Australia’s sheep meat production mix. According to data from Meat and Livestock Australia, in 2021–22 the saleyard price of lamb was 36% higher per kilogram than older sheep. This means that as the proportion of lamb increases, the average price received by the producer also increases.

AUSTRALIAN EXPORTS TO BENEFIT FROM REDUCED TARIFFS

Recent FTAs with the UK and India include improved import conditions for Australian sheep meat.

On entry into force, the Australia-UK FTA will almost triple the amount of Australian sheep meat that can be exported to the UK tariff-free.

Under an existing World Trade Organization (WTO) quota, Australia has tariff-free access for over 13,000 t of sheep meat exports to the UK. Once this limit is reached, tariffs increase to 12% + A$2.50 per kilogram. As of 31 October 2022, Australia has shipped 96% of the current sheep meat quota.

Once the Australia-UK FTA enters into force, Australia can export an additional 25,000 t of sheep meat to the UK. This is on top of the existing WTO quota before tariffs are imposed. Australia’s quota will increase each year before reaching 75,000 t by year 10 (total 88,000 t, including the WTO quota).

Under the Australia-India Economic Cooperation and Trade Agreement, the tariff on Australian sheep meat exports to India will drop from 30% to zero.

Australia is also seeking improved access for sheep meat as part of the Australia-EU FTA negotiations. As of 31 October, Australia has shipped 94% of the current sheepmeat quota (5,900 t) to the EU.

”By 2031, sheep meat consumption is expected to rise by 4% in the UK and 14% in India.

DEPARTMENT OF FOREIGN AFFAIRS AND TRADEwww.dfat.gov.au

FIGURE 3 : AUSTRALIAN SHEEP MEAT EXPORTS BY COUNTRY (2017-2018 TO 2021-2022)

Earlier trade agreements with the US and China, Australia’s 2 major sheep meat markets (Figure 3), also continue to provide benefits.

Australian sheep meat has tariff-free access to the US under the Australia-United States Free Trade Agreement. In 2021–22, Australian exported A$1.2 billion of sheep meat to the US.

Tariffs on Australian sheep meat exports to China are steadily declining under the China-Australia Free Trade Agreement. Since entry into force in December 2015, tariffs on Australian sheep meat have fallen from as high as 23% to between 1.3% and 2.6%. In 2023, the rate reduces to zero. In 2021–22, Australia exported A$1.1 billion of sheep meat to China.

POTENTIAL DISRUPTIONS TO FUTURE SHEEP MEAT DEMAND

Demand for sheep meat could be affected by reduced economic growth, particularly in countries that are large sheep meat consumers, such as the US and China (Source: ABARES 2022). Slowing economic growth will reduce consumer incomes, which could lead to reduced meat consumption, or slower meat consumption growth.

Sheep meat production is concentrated in Australia and New Zealand. Two factors will have a substantial impact on global sheep meat supplies:

- Maintenance of favorable biosecurity conditions in both countries.

- The ability of farmers to adapt to changing weather patterns.

BACKGROUND ON OECD-FAO AGRICULTURAL OUTLOOK

Each year, the Organisation for Economic Co-operation and Development (OECD) and Food and Agriculture Organisation (FAO) publishes the AGRICULTURAL OUTLOOK. The outlook assesses world food supply and demand expectations. It highlights the economic and social trends driving global agricultural commodity markets.